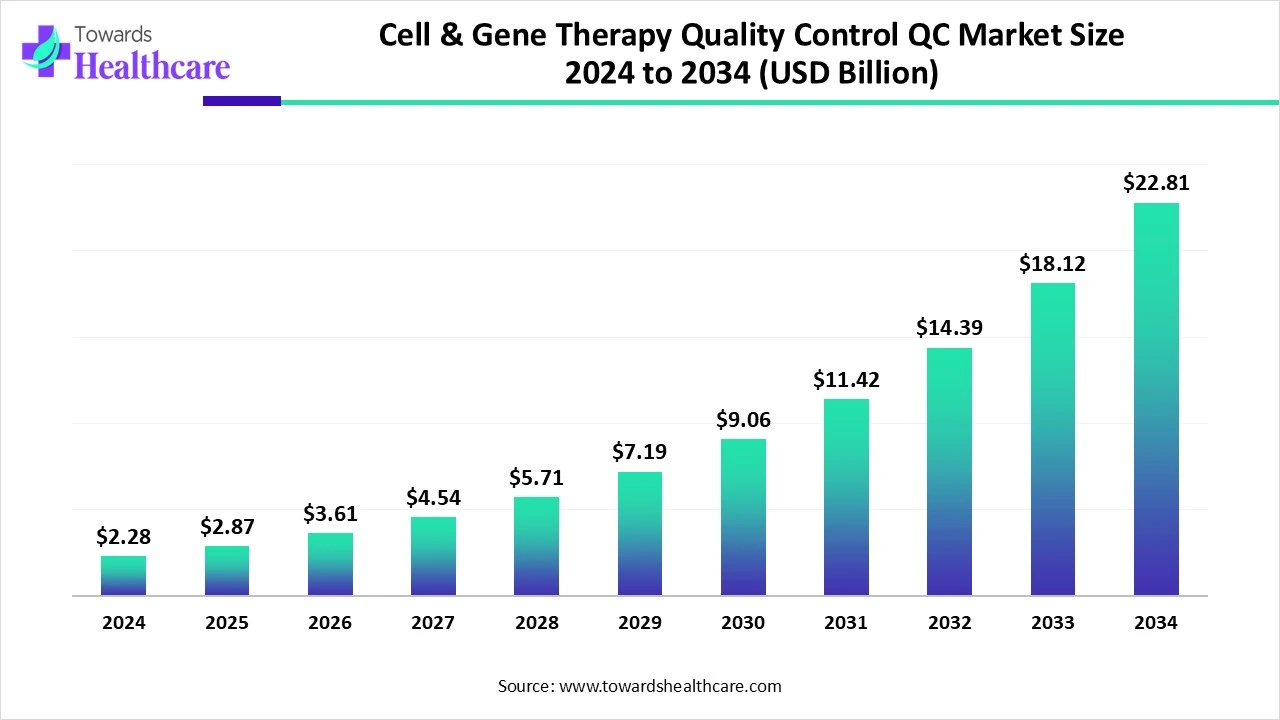

Cell & Gene Therapy Quality Control Market Poised USD 22.81 Billion at 25.74% CAGR by 2034

The cell and gene therapy quality control market size is calculated at USD 2.87 billion in 2025 and is expected to reach around USD 22.81 billion by 2034, growing at a CAGR of 25.74% for the forecasted period.

Ottawa, Oct. 29, 2025 (GLOBE NEWSWIRE) -- The global cell and gene therapy quality control market size was valued at USD 2.28 billion in 2024 and is predicted to hit around USD 22.81 billion by 2034, rising at a 25.74% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The global cell & gene therapy quality control market is driven by its expanding healthcare applications and growing innovations.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5854

Key Takeaways

- North America held the major revenue share of 43% in the market in 2024.

- Asia Pacific is expected to witness the fastest growth in the cell & gene therapy quality control market from 2025 to 2035.

- By testing type, the sterility testing segment held the major revenue share of 23% in the market in 2024.

- By testing type, the potency testing segment is expected to witness the fastest growth in the market from 2025 to 2035.

- By product & service, the kits & reagents segment held the major revenue share of 43% in the market in 2024.

- By product & service, the contract testing services segment is expected to witness the fastest growth in the market from 2025 to 2035.

- By therapy type, the gene therapy segment held the major revenue share of 58% in the market in 2024.

- By therapy type, the non-viral gene therapy segment is expected to witness the fastest growth in the market from 2025 to 2035.

- By stage, the clinical trial QC segment held the major revenue share of 50% in the market in 2024.

- By stage, the commercial production QC segment is expected to witness the fastest growth in the market from 2025 to 2035.

- By end user, the pharmaceutical & biotechnology companies segment held the major revenue share of 60% in the cell & gene therapy quality control market in 2024.

- By end user, the CDMOs segment is expected to witness the fastest growth in the market from 2025 to 2035.

What Is the Cell and Gene Therapy Quality Control?

The cell & gene therapy quality control market is driven by growing technological advancements, increasing demand for cell and gene therapies, and stringent regulatory requirements. The cell & gene therapy quality control encompasses the process and tests utilized to ensure the safety and effectiveness of cell and gene therapies in compliance with the regulatory standards. They are used for detecting microbial contamination, identification of compositions, and detection of product potency, purity, and stability.

Key Metrics and Overview

| Metric | Details | |

| Market Size in 2025 | USD 2.87 Billion | |

| Projected Market Size in 2034 | USD 22.81 Billion | |

| CAGR (2025 - 2034) | 25.74 | % |

| Leading Region | North America | |

| Market Segmentation | By Testing Type, By Product & Service, By Therapy Type, By Stage, By End-User, By Region | |

| Top Key Players | Charles River Laboratories, Eurofins Scientific, Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), Sartorius AG, Bio-Rad Laboratories, QIAGEN N.V., Danaher Corporation (Cytiva), Promega Corporation, WuXi AppTec, Lonza Group AG, Agilent Technologies, Illumina, Inc., Bio-Techne Corporation, Samsung Biologics, Labcorp Drug Development, BlueBird Bio QC Labs, Paragon Bioservices (Catalent), GenScript Biotech Corporation, Avance Biosciences | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Major Growth Drivers in the Market?

The growing use of cell and gene therapies is the major driver in the cell & gene therapy quality control market. They are being used for various diseases, which is increasing their demand, production, and innovations. Additionally, the growing technological innovations, increasing demand for personalized medicines, and expanding CDMO services are other market drivers.

What are the Key Drifts in the Market?

The cell & gene therapy quality control market has been expanding due to the growing funding to launch and enhance the use of various cell & gene therapy quality control methods.

- In May 2025, a total of SEK 80 million in new funding was secured by Symcel, which will support the commercialization of its biocalorimetric platform. The platform will offer the detection of microbial contamination at a faster rate, along with real-time metabolic monitoring.

- In December 2024, a successful completion of €30 million Series D funding round was announced by miDiagnostics, where this investment will be used to enhance the development of batch release sterility test and related quality control tests for the BioPharma Industry.

What is the Significant Challenge in the Market?

High manufacturing cost is the major limitation in the cell & gene therapy quality control market. The manufacturing of cell and gene therapies requires specialized equipment along with their advanced testing facilities, which increases their QC costs. Moreover, scalability problems, lack of skilled personnel, and regulatory barriers are other market challenges.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis

Why did North America Dominate the Market in 2024?

In 2024, North America captured the biggest revenue share of 43% in the cell & gene therapy quality control market, due to the presence of a well-developed healthcare infrastructure, which uses cell and gene therapy quality control tests to deal with its growing production. The growing R&D, supported by healthcare investments, and a growth in the collaborations among the industries, have increased the adoption and use of these platforms. Thus, these advancements and growing chronic diseases contributed to the market growth.

What Made the Asia Pacific Show the Fastest Growth in the Market in 2024?

Asia Pacific is expected to host the fastest growth in the cell & gene therapy quality control market during 2025-2035, due to the growing disease burden and the increasing use of cell and gene therapy quality control. The expanding healthcare, supported by government and private investments, is driving the adoption of advanced technologies and therapies, which are increasing their utilization and encouraging their innovations. Thus, this is promoting the market growth.

Download the single region market report @ https://www.towardshealthcare.com/checkout/5854

Segmental Insights

By Testing Type Analysis

Why Did the Sterility Testing Segment Dominate in the Market in 2024?

By testing type, the sterility testing segment led the cell & gene therapy quality control market with 23% share in 2024, as they were essential for cell and gene therapy manufacturing. This, in turn, helped in minimizing the microbial contamination during their development. As they utilize living cells, they are used to maintain the sterility of the therapies.

By testing type, the potency testing segment is expected to show the highest growth in the market from 2025 to 2035. Due to the heterogeneity of cell and gene therapies, the use of potency testing is increasing. The growing development and innovations of these therapies are driving their demand.

By Product & Service Analysis

Which Product & Service Type Segment Held the Dominating Share of the Market in 2024?

By product & service, the kits & reagents segment held the dominating share of 43% in the cell & gene therapy quality control market in 2024, driven by their increased repeated use. The use of reagents varies depending on the type of QC testing. The growth in the development of ready-to-use kits also increased their use.

By product & service, the contract testing services segment is expected to show the fastest growth rate in the market from 2025 to 2035. The growing production of cell and gene therapies is increasing the use of these services. The expanding industries and outsourcing trends are also contributing to the same.

By Therapy Type Analysis

What Made Gene Therapy the Dominant Segment in the Market in 2024?

By therapy type, the gene therapy segment led the cell & gene therapy quality control market with 58% in 2024, due to its growing applications. The growing R&D investments have also increased the use of cell and gene therapy quality control tests. The growth in their advancements and personalization also enhanced their adoption rates.

By therapy type, the non-viral gene therapy segment is expected to show the highest growth in the market from 2025 to 2035. The use of non-viral gene therapy is increasing as they do not show immunogenicity, reducing side effects, is increasing the use of QC assay to maintain its safety profile. Their growing applications and innovations are also increasing their use.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By Stage Analysis

Why Did the Clinical Trial QC Segment Dominate in the Market in 2024?

By stage, the clinical trial QC segment led the cell & gene therapy quality control market with a 50% share in 2024, driven by growth in clinical trials. They are being used to ensure the potency and efficacy of the complex therapies. They were also used to ensure patient safety during the clinical trials.

By stage, the commercial production QC segment is expected to show the fastest growth rate in the market from 2025 to 2035. The rise in the manufacturing and launches of cell and gene therapies is increasing the use of commercial production QC. The large-scale production is also enhancing their use.

By End-user Analysis

How did the Pharmaceutical & Biotechnology Companies Segment Dominate the Market in 2024?

By end user, the pharmaceutical & biotechnology companies segment held the largest share of 60% in the cell & gene therapy quality control market in 2024, due to growth in cell and gene therapy R&D. They were further supported by healthcare investments, which increased the use of QC tests. The growth in their manufacturing also increased their use.

By end user, the CDMOs segment is expected to show the highest growth in the market from 2025 to 2035. The growing technological innovation and growing demand for cell and gene therapies are increasing the demand for QC tests. The growing collaborations and outsourcing trends are also contributing to their increased use.

Browse More Insights of Towards Healthcare:

The cell and gene therapy infrastructure market is experiencing strong upward momentum, with substantial revenue growth anticipated over the forecast period from 2025 to 2034, potentially reaching hundreds of millions of dollars.

The North America cell and gene therapy market is valued at US$ 9.19 billion in 2024, expected to rise to US$ 11.34 billion in 2025, and projected to reach approximately US$ 79.01 billion by 2034, expanding at a CAGR of 24.01% during the forecast period.

Across Europe cell and gene therapy market stands at US$ 2.74 billion in 2024, increasing to US$ 7.17 billion in 2025, and is forecasted to achieve US$ 48.96 billion by 2034, with a robust CAGR of 23.90% from 2025 to 2034.

In the Asia-Pacific (APAC) region cell and gene therapy market is valued at US$ 4.59 billion in 2024, growing to US$ 5.71 billion in 2025, and expected to reach around US$ 39.62 billion by 2034, expanding at a CAGR of 24.04% over the same period.

The Middle East and Africa (MEA) cell and gene therapy market is estimated at US$ 1.15 billion in 2024, rising to US$ 1.41 billion in 2025, and projected to hit approximately US$ 9.75 billion by 2034, advancing at a CAGR of 23.85% between 2025 and 2034.

Meanwhile, the Latin America cell and gene therapy market recorded US$ 1.15 billion in 2024, expected to increase to US$ 1.42 billion in 2025, and likely to reach US$ 10.19 billion by 2034, registering a CAGR of 24.40% throughout the forecast timeline.

Beyond regional growth, several key segments within the global cell and gene therapy ecosystem are also witnessing rapid expansion. The global cell and gene therapy thawing equipment market is valued at US$ 0.96 billion in 2024, projected to grow to US$ 1.1 billion in 2025 and reach US$ 3.56 billion by 2034, with a CAGR of 14.24%.

The global cell and gene supply chain solutions market stands at US$ 3.54 billion in 2024, growing to US$ 4.09 billion in 2025, and expected to attain US$ 14.95 billion by 2034, expanding at a CAGR of 15.54%.

Similarly, the global cell and gene therapy tools and reagents market is valued at US$ 10.04 billion in 2024, projected to rise to US$ 11.12 billion in 2025, and reach US$ 27.3 billion by 2034, growing at a CAGR of 10.76%.

Lastly, the global cell and gene therapy bioassay services market is calculated at US$ 5.05 billion in 2024, increasing to US$ 5.67 billion in 2025, and estimated to reach US$ 16 billion by 2034, expanding at a CAGR of 12.24% throughout the forecast period.

Recent Developments in the Market

- In September 2025, a RiboNAT™ Rapid Sterility Test, utilizing the Nucleic Acid Amplification Test (NAT) method, was launched by FUJIFILM Wako Pure Chemical Corporation for rapid cell therapy sterility testing.

- In March 2025, a product sterility testing service utilizing rapid microbiological methods (RMMs) was launched by Nelson Labs, where, for validation of alternative microbiological methods, it complies with USP <71> and <1223>.

Cell & Gene Therapy Quality Control Market Key Players List

- Thermo Fisher Scientific

- Charles River Laboratories

- Merck KGaA (MilliporeSigma)

- Eurofins Scientific

- QIAGEN N.V.

- Sartorius AG

- Danaher Corporation (Cytiva)

- Bio-Rad Laboratories

- Promega Corporation

- Agilent Technologies

- WuXi AppTec

- Illumina, Inc.

- Lonza Group AG

- Labcorp Drug Development

- Bio-Techne Corporation

- BlueBird Bio QC Labs

- Avance Biosciences

- Samsung Biologics

- Paragon Bioservices (Catalent)

- GenScript Biotech Corporation

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/checkout/5854

Segments Covered in The Report

By Testing Type

- Sterility Testing

- Traditional culture-based methods

- Rapid sterility tests

- Mycoplasma Testing

- PCR-based

- Culture-based

- Enzymatic

- Endotoxin Testing

- LAL assay

- Recombinant Factor C assay

- Adventitious Agent Testing

- In vivo/in vitro methods

- PCR and NGS-based detection

- Identity Testing

- Flow cytometry

- Immunoassays

- qPCR

- Purity Testing

- Residual DNA

- Residual host cell proteins

- Process-related impurities

- Potency Testing

- Cell-based assays

- Reporter gene assays

- Vector copy number testing

- Genetic Stability Testing

- Karyotyping

- FISH (Fluorescence In Situ Hybridization)

- Whole genome/exome sequencing

- Safety Testing

- Replication-competent virus (RCV) testing

- Tumorigenicity assays

By Product & Service

- Kits & Reagents

- Instruments

- Software

- Services

- Contract Testing Services

- Regulatory Consulting

By Therapy Type

- Cell Therapy

- Autologous

- Allogeneic

- Gene Therapy

- Viral Vector-based (AAV, Lentivirus, etc.)

- Non-Viral Vector-based (Plasmid, mRNA)

By Stage

- Preclinical QC

- Clinical Trial QC (Phases I–III)

- Commercial Production QC

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic & Research Institutions

- Regulatory & Government Laboratories

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5854

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.